Know Your Numbers!

FREE Financial Analysis Fundamentals Course

Get instant access to this valuable course so you can easily analyze investments and loans. Take the next step in your journey with confidence.

Understand investments and loans today.

You'll learn:

- How to calculate future value

- How to calculate present value and net present value

- How to calculate rate of return on investment

- How to calculate loan payments

- How to calculate loan balances

- How to calculate balloon payments

- How to calculate cash flows

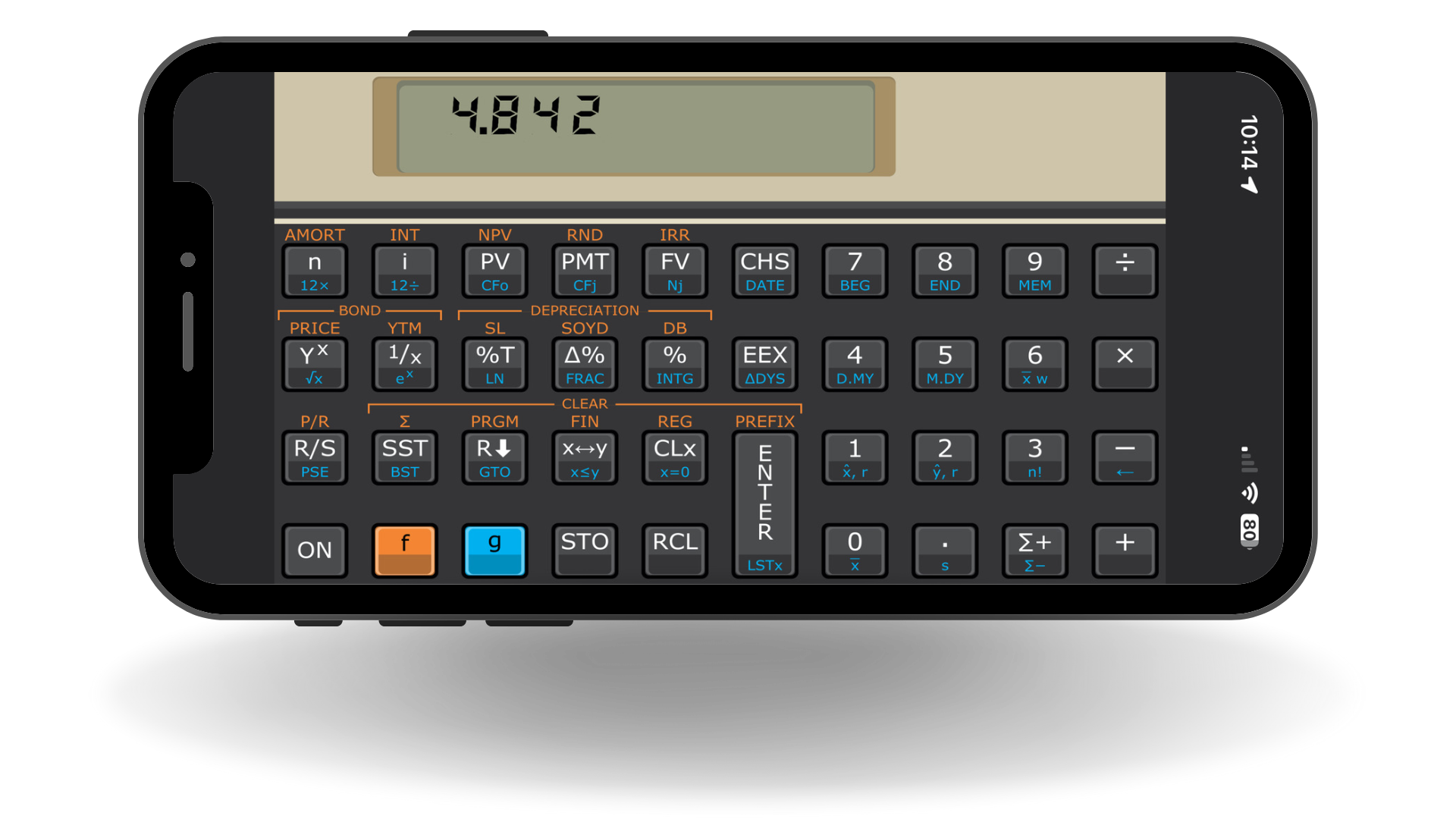

- How to use a Financial Calculator (HP 12c)

Do math & finance make you you nervous?

Not anymore.

Forget spending hours anxiously trying to figure it out. You don't need to wonder what it takes to 'know your numbers’. I will help you feel confident in your ability to understand financial analysis in just a few hours.

This course course makes it easy. Guaranteed.

Includes FREE calculator apps

and pre-built spreadsheet templates

Get the Free Course

Course Overview

“Calculate a loan payment faster than you can open your laptop.”

“Years later, I still use it every day.”

" ⭐️⭐️⭐️⭐️⭐️ "

- Read the Google reviews

Modules and Lessons

Fundamentals of Finance and Investments

-

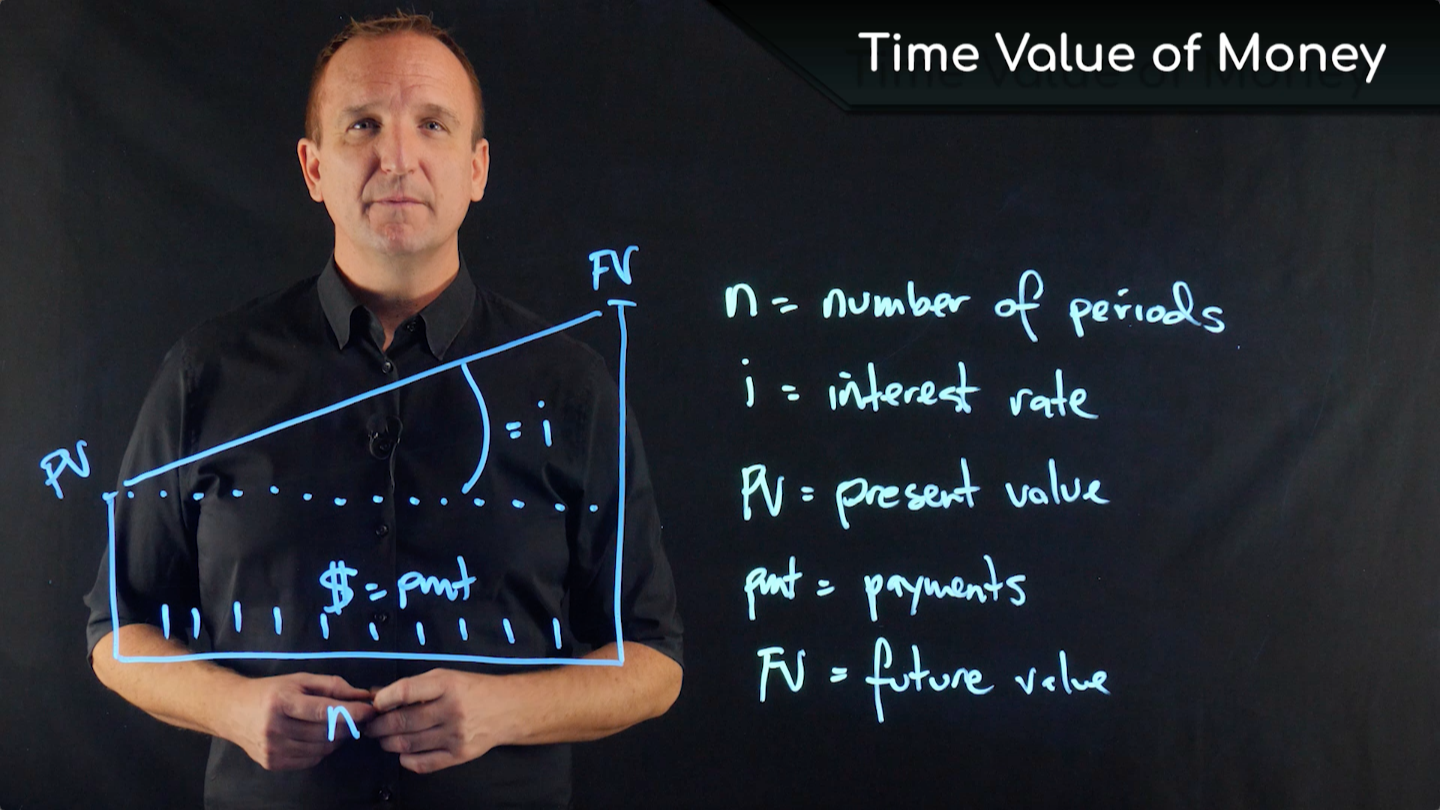

Time value of money overview

-

Compound interest

-

Risk & reward

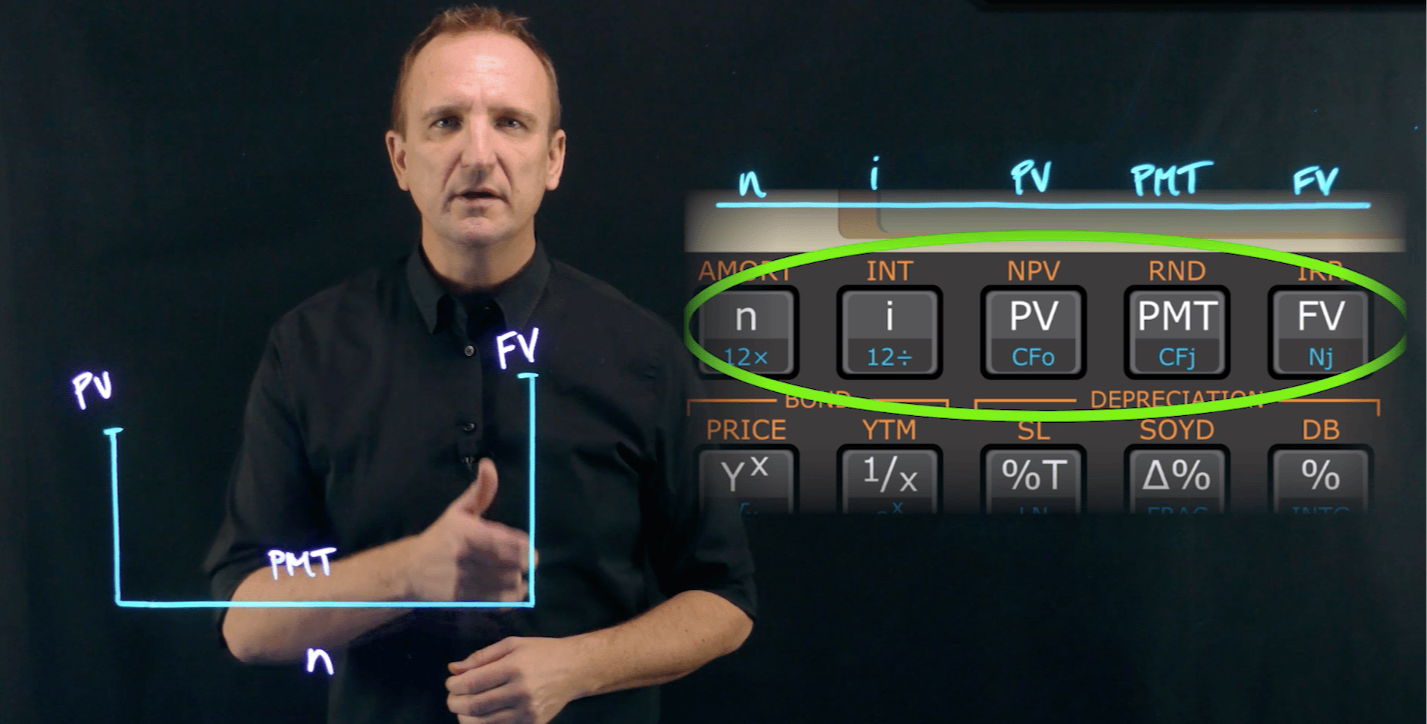

How to Use a Financial Calculator

-

Overview and Free calculator apps to download

-

HP 12c tour of functions

-

Reverse Polish Notation ‘RPN’ and Stacking

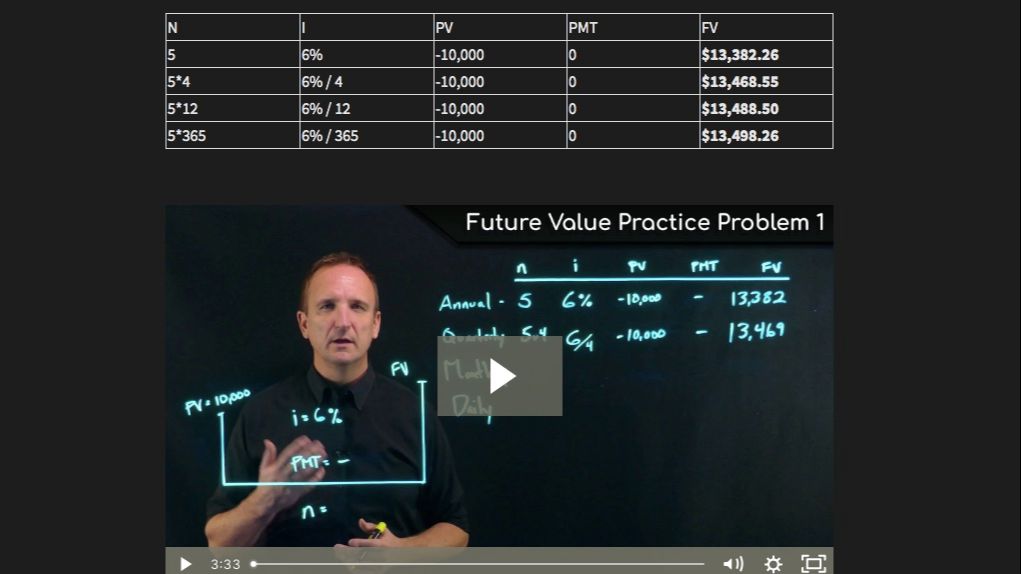

Time (n) and Future Value (FV)

-

Number of Compounding Periods

-

Future Value

-

Practice problems with step-by-step solutions

Present Value (PV)

-

Present Value

-

Net Present Value

-

Present Value Practice

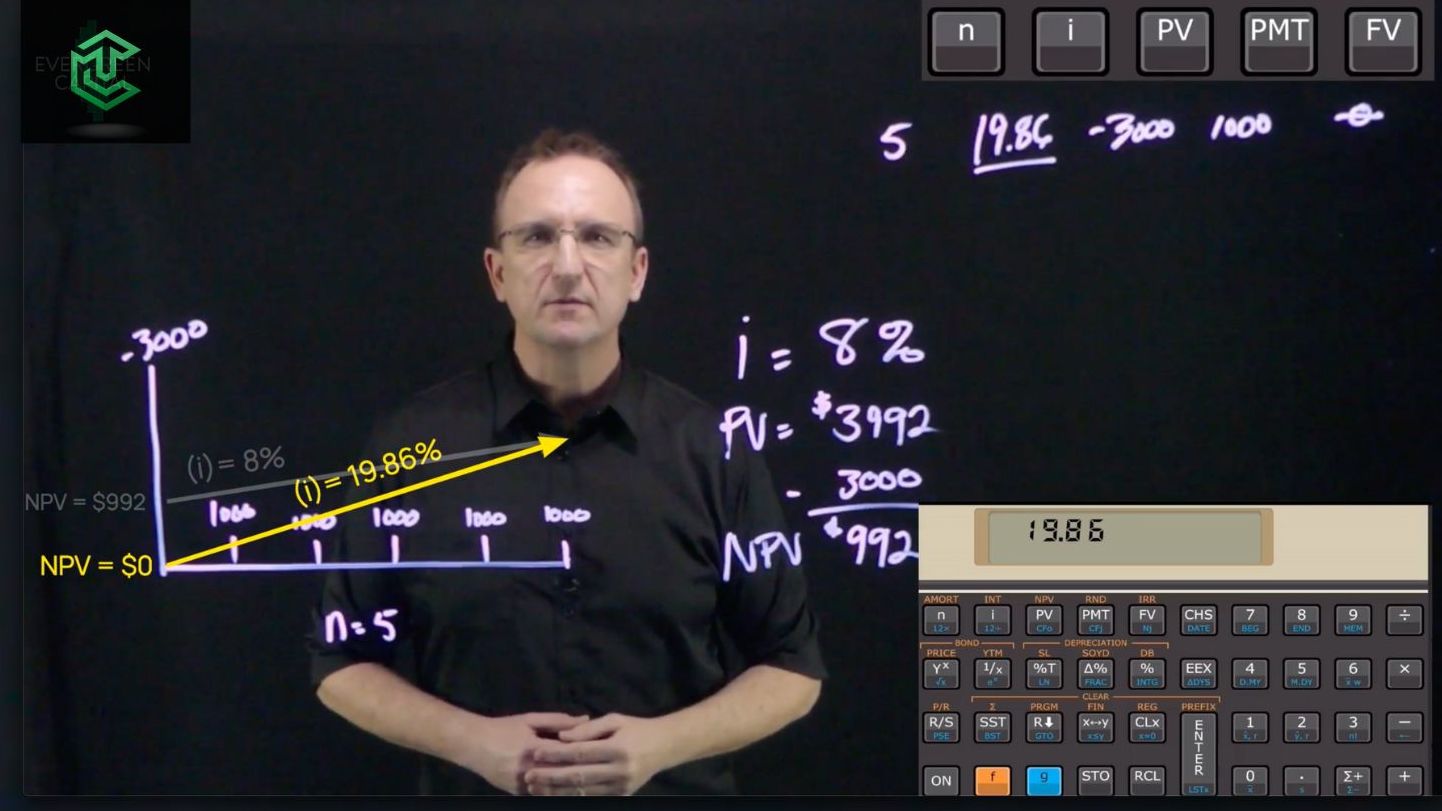

Internal Rate of Return / Interest Rate (i)

-

Internal Rate of Return (IRR)

-

How Interest Rates are Determined

-

Rate of Return Practice

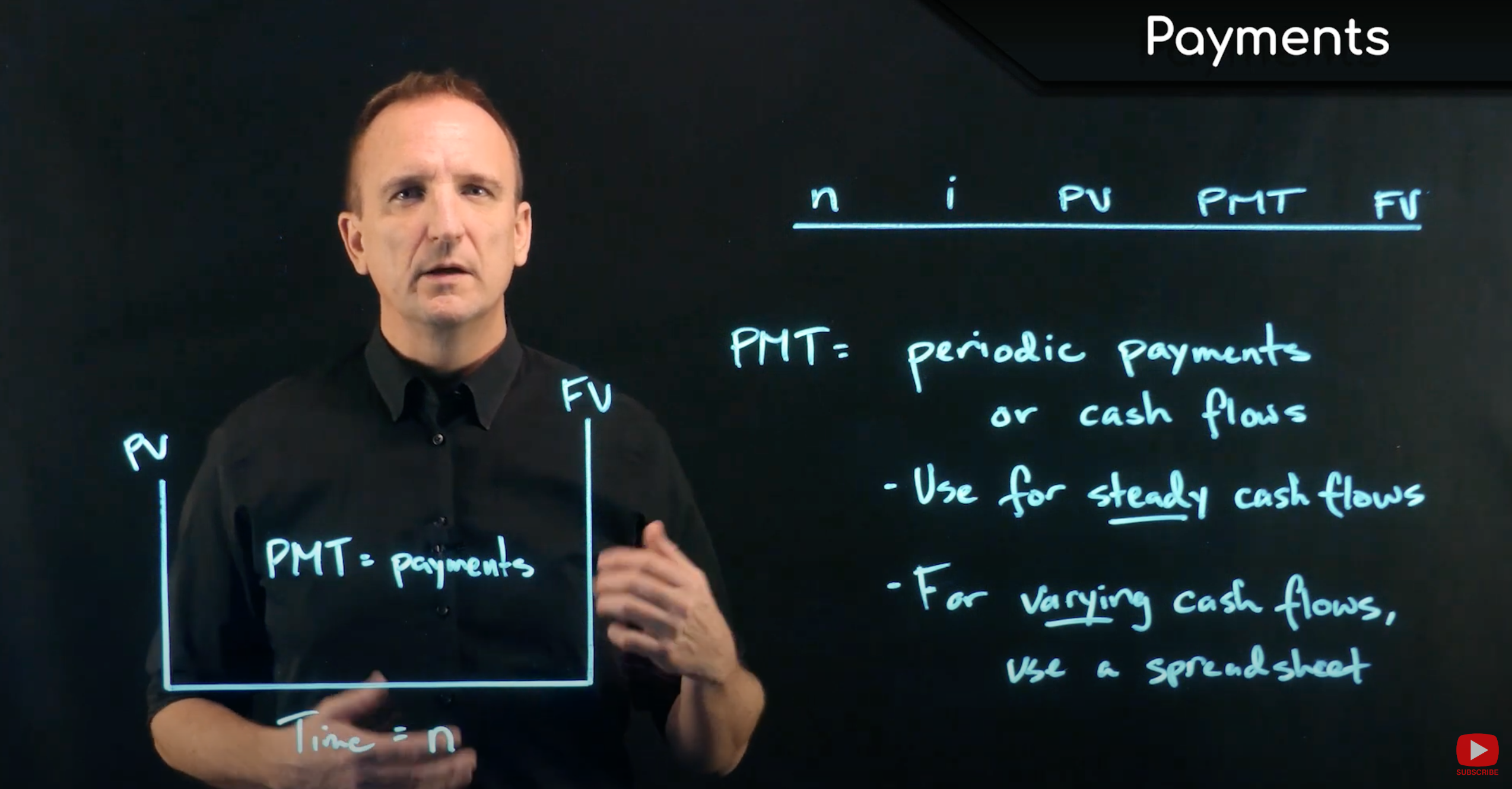

Payments and Cash Flows (PMT)

-

Payments and Cash Flows

-

Discounted Cash Flow DCF

-

Payments Practice

How to Calculate Mortgage Loan Payments, Balances, and Balloon Payments

-

Fully Amortizing Payments

-

Future Balances

-

Payoff Amounts

Bonus and Extras

Links to Free HP12c Financial Calculator Apps

Get started immediately with free apps for iPhone & Android.

Step-by-Step Instructions and Access to Your Instructor

Get plenty of practice with the confidence that you won’t get lost or fall behind.

Tons of Bonuses

and Extras

We always keep a few surprises up our sleeve to keep you smiling.

Are you ready to know your numbers?

Look Inside

-

Welcome & Introductions

4 lessons- STOP! Watch this video BEFORE you begin.

- About This Course and Your Instructor

- How to Use This Course

- About You and Your Goals

-

Fundamentals of Finance & Investments

4 lessons- Compound Interest vs. Simple Interest

- The Time Value of Money

- The Difference Between APR and APY

- Test your learning: Introduction to the Fundamentals of Finance & Investments

-

Your Most Valuable Tool - The Financial Calculator

13 lessons- Introduction to Financial Calculators

- List of Financial Calculators and Apps You Can Download NOW!

- How I Show Calculator Inputs on the Board

- Financial Calculator - Tour of Functions

- Changing the Decimal Display

- Using the 'g'-Key

- Entering RATE in the Calculator

- Financial Calculator - Stacking

- RPN (Reverse Polish Notation)

- PRACTICE - RPN & Stacking

- RPN and Stacking Practice Solutions

- DOWNLOAD: HP 12c Financial Calculator "Video Cheat Sheet"

- Quick Feedback on This Module

-

Future Value - What an Investment Will Be Worth

11 lessons- Time and the Number of Compounding Periods (n)

- Future Value (FV)

- Practice Future Value on Your Financial Calculator

- Future Value - Practice

- Future Value - Practice Solutions

- Practice #2 - Future Value

- Practice #4 Future Value

- Practice #5 Future Value

- Time/Number of Periods (n) - Practice

- Time/Number of Periods (n) - Practice Solutions

- Quick Feedback

-

Present Value - What an Investment is Worth Today

4 lessons- Present Value (PV) Explained

- Net Present Value (NPV)

- Present Value (PV) - Practice

- Present Value (PV) - Practice Solutions

-

Rate of Return and Interest Rates

5 lessons- How Interest Rates are Determined

- Rate of Return - Interest Rate (i)

- Internal Rate of Return "IRR"

- How to Analyze a Real Estate Investment IRR

- IRR and Interest Rate (i) - Practice

-

Payments and Cash Flows

3 lessons- Payments & Cash Flows (PMT)

- Discounted Cash Flow "DCF"

- PRACTICE - Payments & Cash Flows

-

Mortgage Loan Terms: Calculating Payments, Balances, Rates and More

9 lessons- Loan Amortization

- How to Calculate a Loan Payment

- PRACTICE Calculating Loan Payments

- Calculating Loan Payment - Practice Solutions

- SAMPLE SPREADSHEET - How to Calculate a Loan Payment

- What is a Balloon Payment?

- How to Calculate a Loan Balance or Balloon Payment

- PRACTICE Calculating Loan Balances & Balloon Payments

- Loan Balance - Practice Solutions

-

Final Steps

1 lesson- One more step before you complete the 'Know Your Numbers' Crash Course!

Your Instructor

Trevor T. Calton, MBA

Trevor Calton is a former Professor of Real Estate Finance and the founder of Real Estate Finance Academy.

In his career, he has worked as a financial analyst, an investment sales agent, a commercial lender, and asset manager.

Since 1997, he has analyzed, acquired, or sold more than $5 billion of commercial real estate assets, and he has overseen the asset management of more than 6000 units of multifamily housing.

Trevor has trained thousands real estate agents, investors mortgage lenders, and other professionals in the analysis of real estate investments, negotiations, and career building.